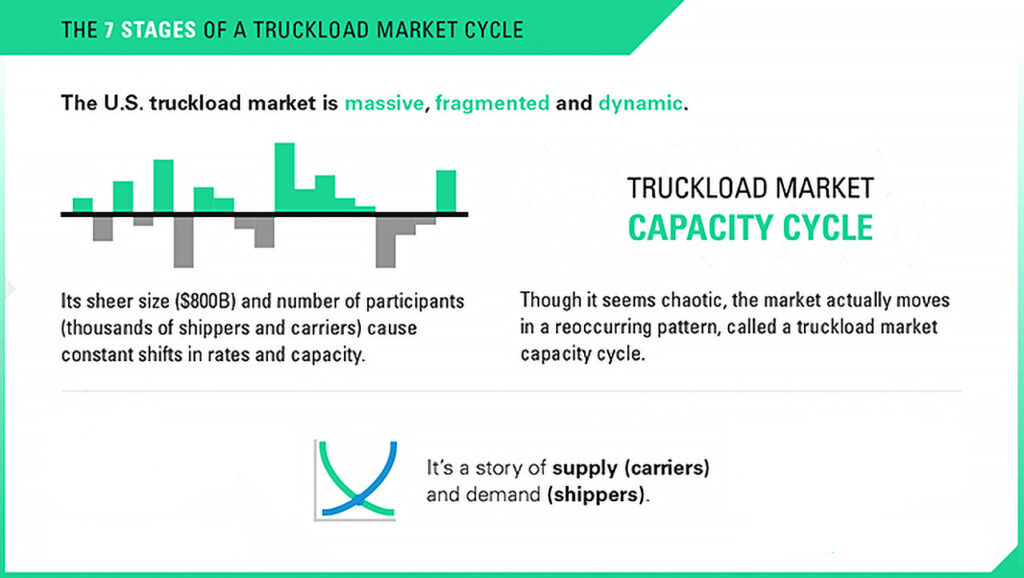

The U.S. truckload market is massive.

It’s a nearly $800 billion industry with thousands of shippers and carriers.

It is also extremely fragmented.

97% of trucking companies have fewer than 20 trucks.

It adds up to a market where carrier supply and shipper demand are constantly shifting.

But there is a method to the madness.

What Is a Truckload Market Cycle?

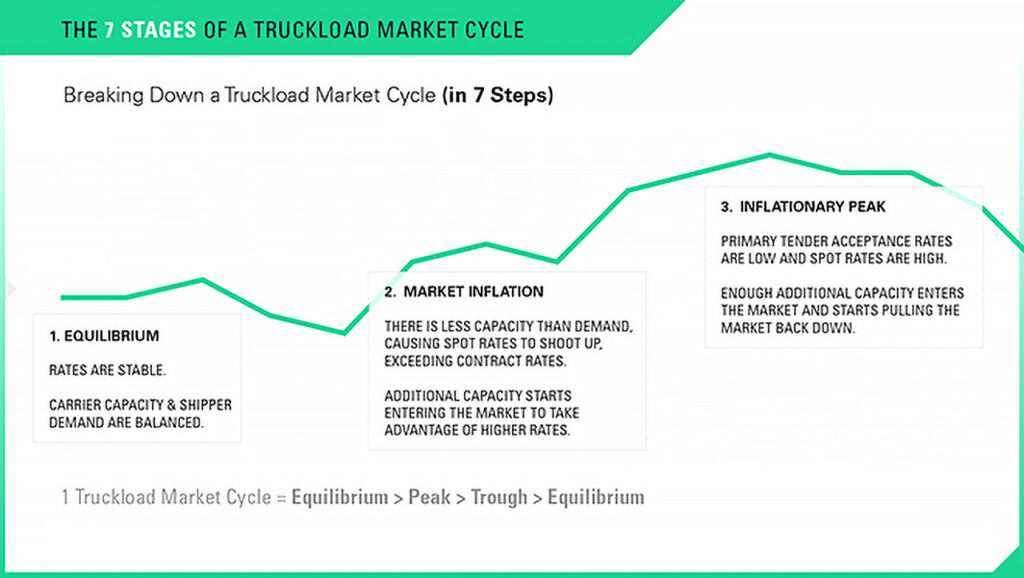

Even though it’s chaotic, the market actually moves in a reoccurring cycle, going from equilibrium (shipper demand and carrier supply are balanced) to inflation (more freight than trucks) to deflation (more trucks than freight) and back to equilibrium.

A full market cycle typically lasts around 10-12 quarters (two to three years).

If you understand how the market moves, you can create a better strategy for your business.

Walk through the 7 stages of a truckload market cycle in the 3 infographics below to learn how rates fluctuate predictably over time.

Overview of a Truckload Market Cycle

A market cycle is really just a story of supply and demand in the truckload market.

Stages 1 to 3: Equilibrium to Peak

As carrier capacity gets tighter relative to shipper demand, spot rates start going up.

This is the rise before the fall.

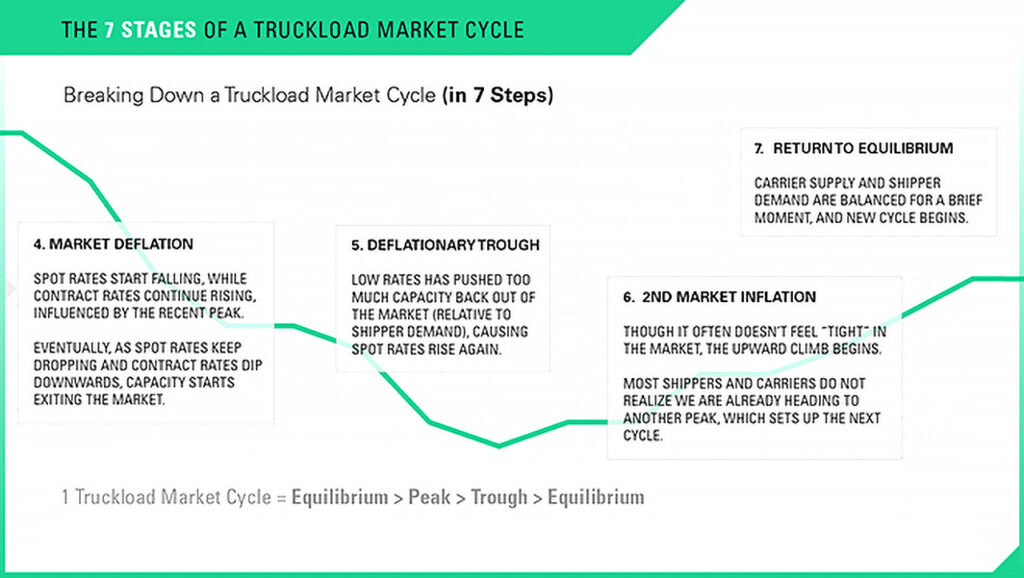

Stages 4 to 7: Deflation, Trough and Return to Equilibrium

Now the overshoot of capacity starts to take effect as the market collapses.

Eventually, rates get low enough for long enough and the market bottoms out. From this low point, it heads back up to equilibrium and the beginning of the next cycle.