Over the past two years, the U.S. truckload market has been humming a relatively consistent tune: lower freight volumes, waning carrier capacity, and a prolonged stable rate environment (though rates have been increasing slightly on a year-over-year basis).

And over our last three quarterly updates, the RXO Curve (our proprietary spot rate index) was trending downwards towards deflation, leading to the critical question: has the truckload cycle turned over?

We didn’t think so, and believed that rates were likely to move higher — how did our prediction fare?

The numbers are in, and the Curve has indeed reversed course, heading higher into an inflationary environment.

As we dive deeper into a new year, will we finally see a meaningful shift in truckload market dynamics?

Was it just Q4 seasonality with weather-related impacts that will taper off?

Should shippers be preparing for a very different freight environment in 2026?

We’ll tell you everything you need to know in the latest truckload market guide.

Q1 Truckload Market:

The Complete Guide for Logistics Pros

What you’ll learn in this comprehensive update:

- Q4 2025 truckload market recap

- Macroeconomic outlook

- 5 trucking trends to watch right now

- Q1 2026 truckload market forecast

New to the Curve?

These essential truckload market resources will give you foundational industry knowledge and teach you how how we build our proprietary spot rate index.

Want slides for your next presentation?

Download all the Curve charts and graphs, formatted for slides.

Spot & Contract Trucking Rate Recap: Q4 2025

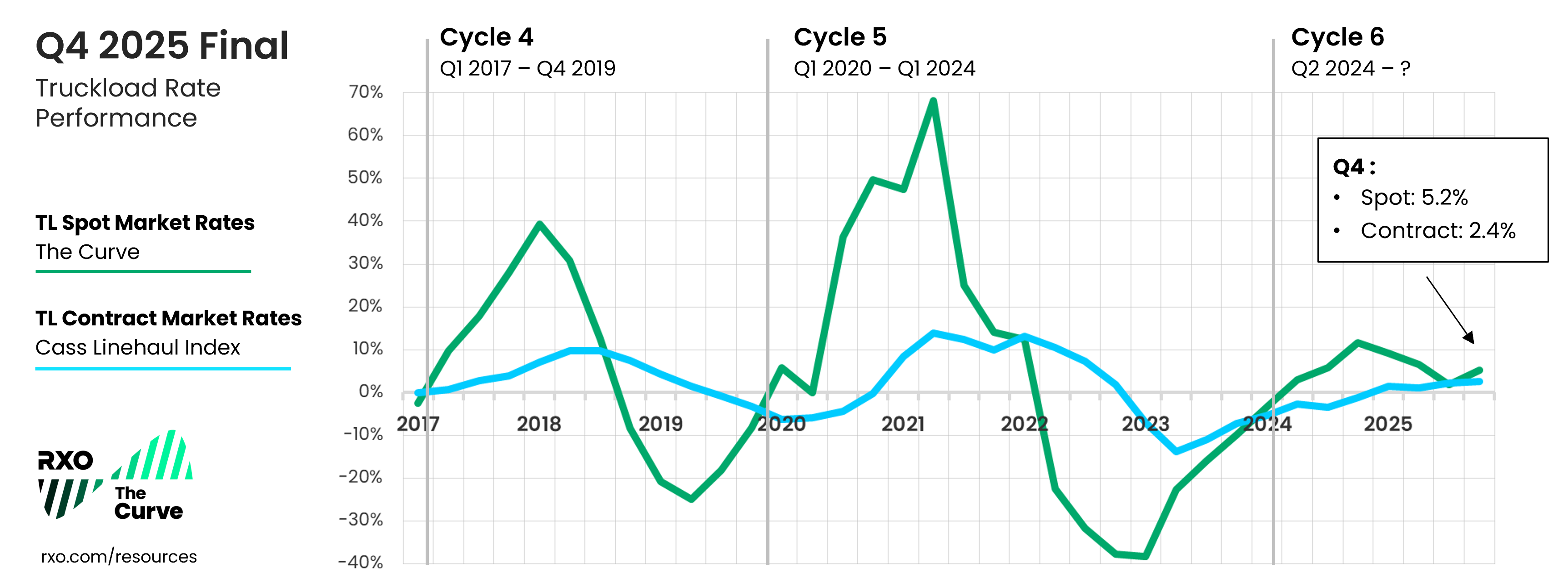

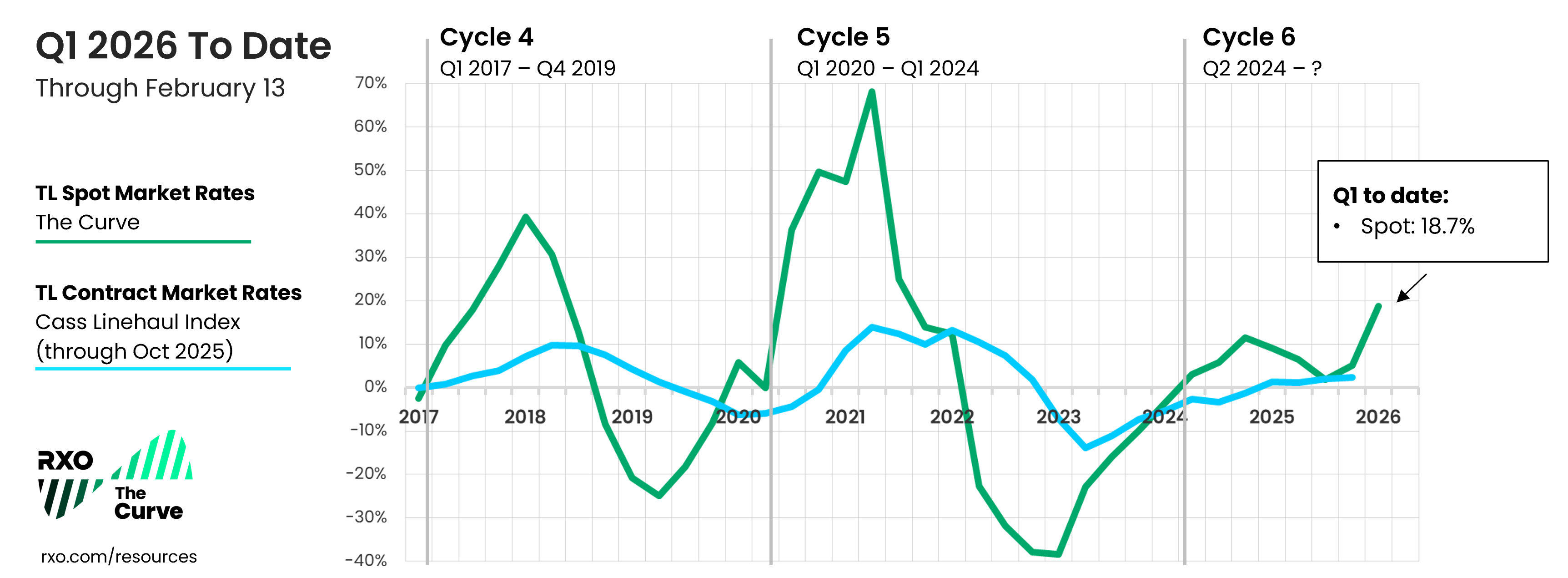

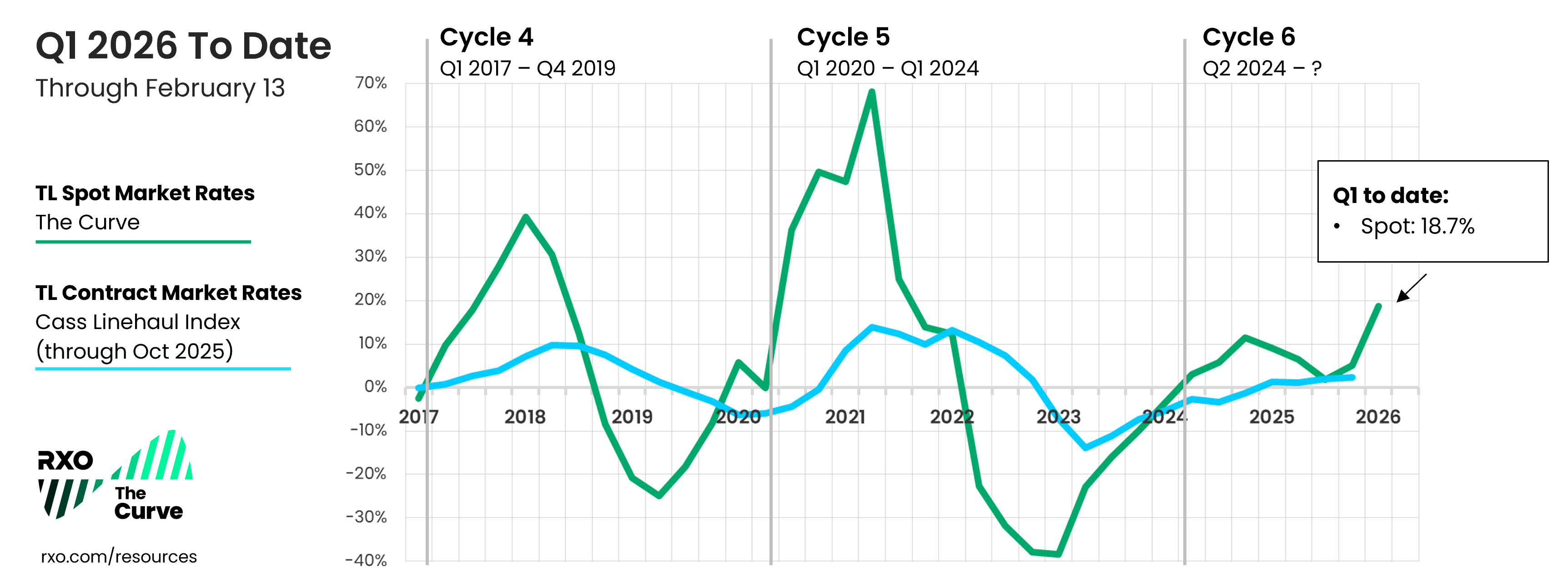

After trending downward for three straight quarters, the RXO Curve index is heading upwards, higher into inflation.

In Q4, we experienced capacity volatility, which drove spot rate increases.

Though some of the volatility was due to seasonality, a large portion was driven by an acceleration of carrier exits (more on that below).

- Q4 truckload spot rates remained inflationary, up from Q3

Truckload spot rates increased 5.2% year-over-year at the end of Q4, up from 1.8% in Q3. - Q4 truckload contract rates remained inflationary, increasing slightly from Q3

Truckload contract rates* increased 2.4% year-over-year, up slightly from 2.1% in Q3.

Download all the Curve charts for your next presentation.

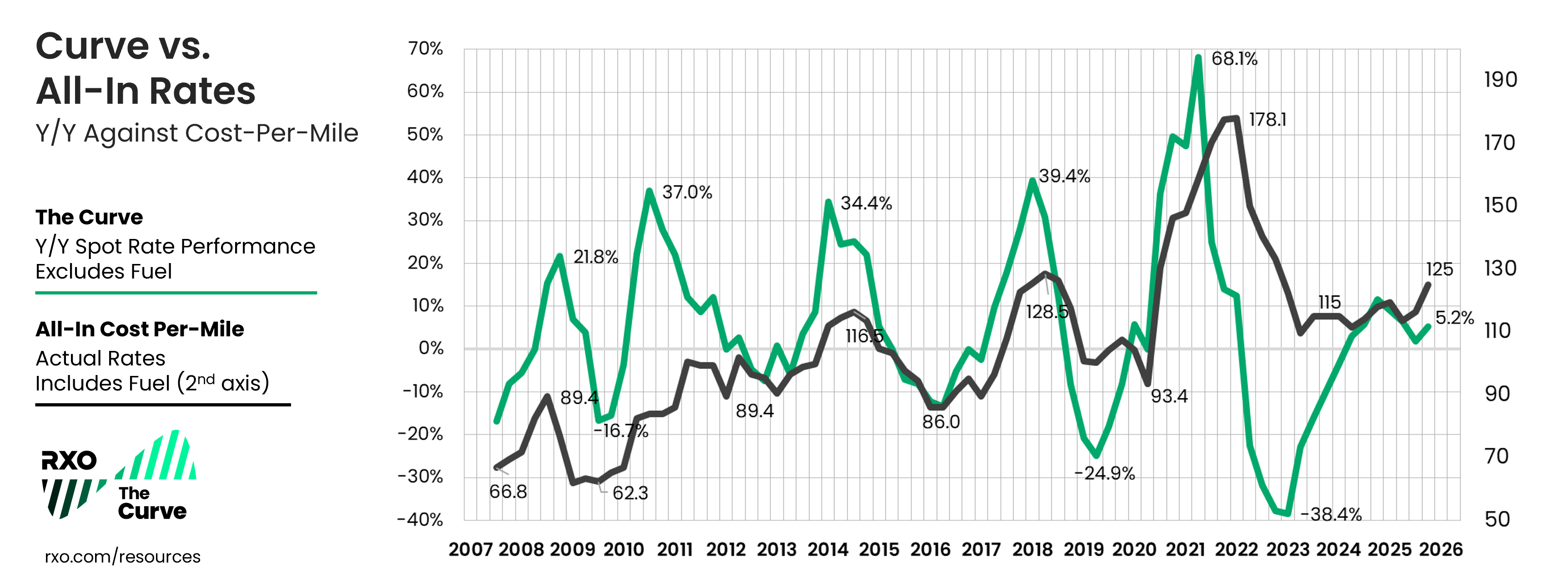

Actual Spot Truckload Rates vs. Year-Over-Year

To build further confidence in the Curve (a year-over-year spot rate index), let’s see it up against our proprietary all-in cost-per-mile index — this is comparing annual change (without fuel) versus the actual rate (all-in cost, with fuel included).

As a reminder, these numbers are informed by real transactional data from thousands of daily shipments over the last 18 years.

Since Q3 2023, this index has been essentially flat, with very little movement, ranging between 111 and 120 (for comparison, during COVID-era shipping in the early parts of the previous market cycle, the index troughed at 93.4 and peaked at 178.1).

In Q4 2025, the all-in index ticked up to 125 (from 116.4 in Q3), the highest reading since Q4 2022.

Download all the Curve charts for your next presentation.

The Curve declined (sequentially) for three straight quarters, then reversed course — what is going on?

In previous truckload market cycles, when shipping events hit during the upswing into inflation, they tended to accelerate market activity (i.e., pouring lighter fluid on the bonfire).

In this market cycle, major shipping events (e.g., produce season, DOT week, summer shipping, peak season build-up) were not having the same sustained impact on spot rates, giving rise to the question: what will it take for the Curve to experience continued inflation?

Throughout 2025, we maintained that, though conditions were relatively stagnant, rates were unlikely to move materially lower and the market may be setting up for a period of future rate volatility.

Here’s why we believed it was a kink in the line, and not the end of the cycle:

1. We’ve seen trends reverse course during previous cycles.

This is far from atypical — look at previous cycles and you’ll find seven other examples of when the Curve has trended down during an upswing or trended up during a downswing.

The key is taking a long view of cycle activity to determine the overarching trend. Though this was certainly a longer deviation, the current dynamics of the truckload market were unable to support a deep drop into a trough (see next point).

2. It would have been difficult for rates to move materially lower.

Looking at the all-in index, in absolute terms, carriers were getting similar spot rates to those they were getting during the market peak in 2014, though their operating costs (diesel, insurance, labor, etc.) have risen significantly since then.

For context, the average marginal cost to operate a truck in 2024 (latest available) was around 34% higher than in 2014, according to the American Transportation Research Institute.

Simply put, it was difficult to envision freight rates dropping materially, as many carriers have been running with unsustainable unit economics.

Q4 2025 Truckload Market: Key Takeaways

- The Curve (measuring year-over-year in linehaul spot rates, excluding fuel) remained in year-over-year inflation, up sequentially from Q3

- All-in rates (actual amount paid to carriers) increased to their highest level in three years.

- Though Q4 was still predominantly a shippers’ market, the dynamic started to shift by December.

- Despite improving spot rates, carriers remained under significant cost pressure, while shippers enjoyed relatively high tender acceptance rates, easy capacity and modest rate increases in their RFPs.

State of the Industry: Macroeconomic Overview

Overall, the U.S. macroeconomic environment remains in a similar spot as the last serval quarters.

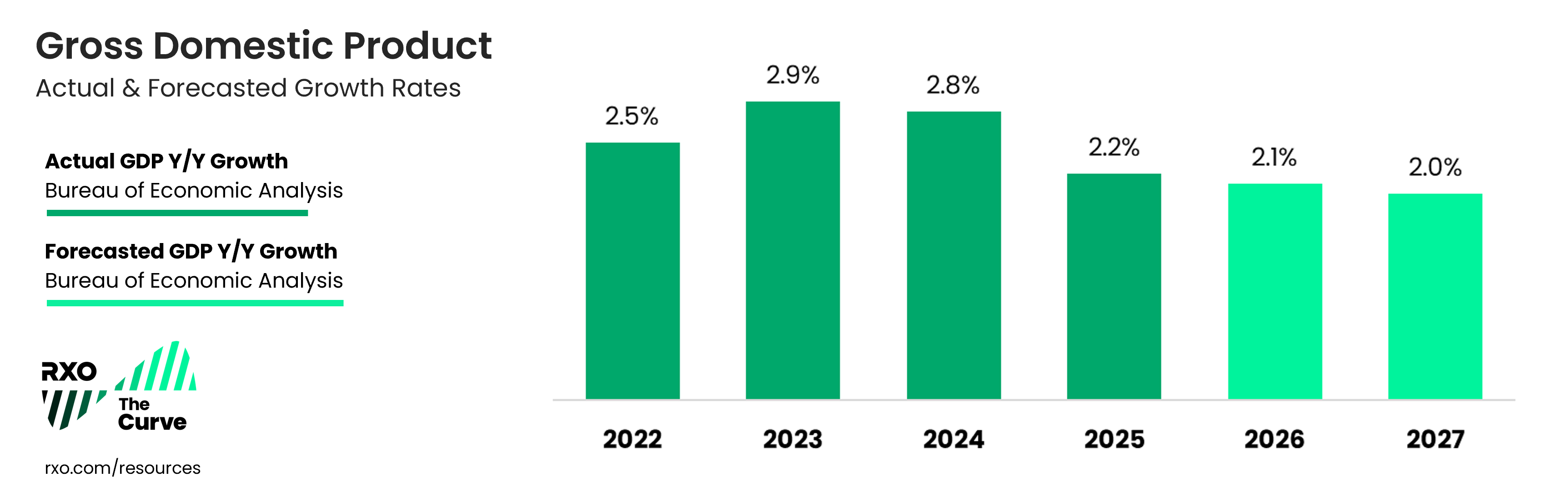

Through Q4, U.S. real gross domestic product (GDP) has remained stable, at 2.2% growth year-over-year.

Though tariffs and trade policy shifts have stabilized compared to earlier in the year, there is still a looming overhang of uncertainty and consumer anxiety.

Inflation & Interest Rates

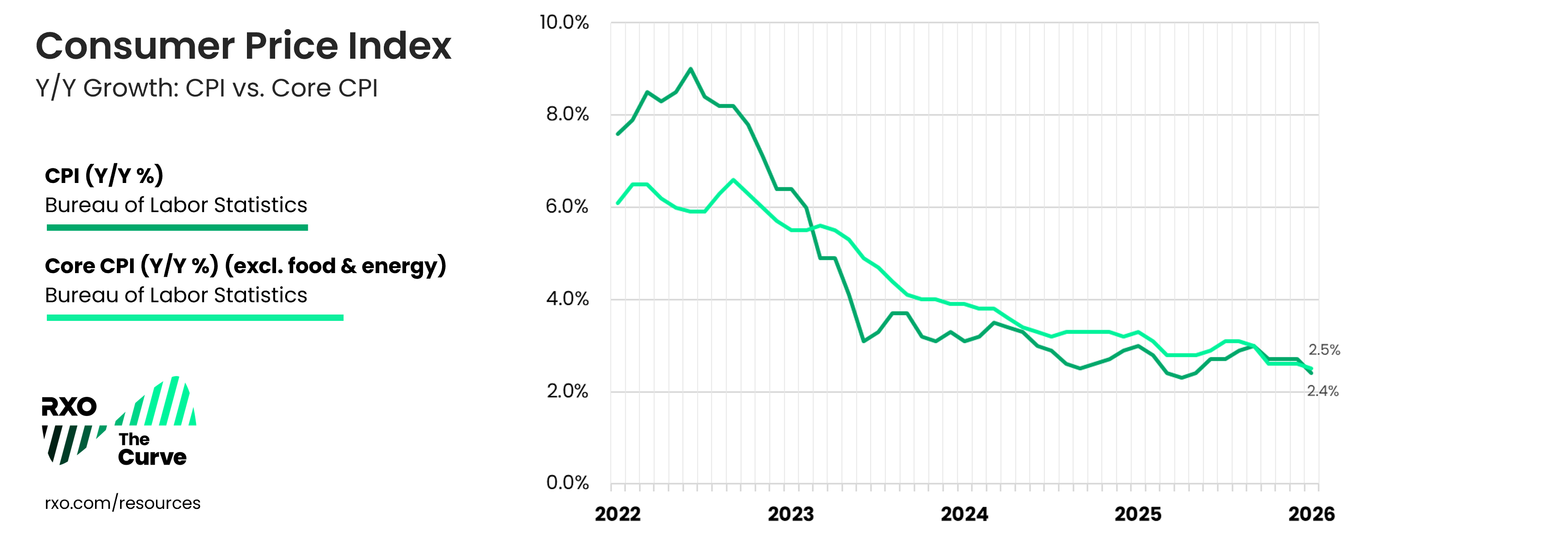

Though inflation has eased considerably over the past three years, it remains persistently higher than the Federal Reserve’s target rate of 2%.

After rising to 3.0% year-over-year in September, the Consumer Price Index (CPI) eased to 2.7% and held steady in October through December, then eased again in January 2026 to 2.4%.

The core Consumer Price Index (CPI), which excludes volatile food and energy costs, dropped slightly lower to 2.6% in October through December, and 2.5% in January 2026.

Tariff and Trade Policy Impact

Throughout 2025, the U.S. government struck several important deals with major trading partners, and the average effective tariff rate for the U.S. has remained effectively flat since May last year.

At this point, most non-tariffed goods (purchased in a flurry of imports early last year) have already worked their way through domestic supply chains.

With shippers now buying imports at higher rates, they are faced with shrinking profitability or passing through increased costs to consumers.

The Supreme Court struck down the Trump Administration’s tariffs — What now?

The legal basis for much of the Administration’s trade policy hinged on the ability to use broad emergency powers to implement tariffs (specifically, the International Emergency Economic Powers Act or IEEPA). In the past, tariffs were generally under the purview of Congress.

Several small businesses and a group of states are challenging the legality of these tariffs, which they contend are an overreach of executive branch authority.

The case made its way through the lower courts, and reached the U.S. Supreme Court, which had an initial hearing on November 5th.

On February 20th, the Supreme Court ruled that the tariffs exceed the powers given to the president under IEEPA.

Though this ruling struck down most of this administration’s tariffs, it did not weigh in on whether or not the U.S. government will have to refund shippers (which will likely play out in lower courts over an extended period of time).

However, the administration can still pursue several options to maintain global tariff rates, including:

- Section 122 of the Trade Act of 1974 (tariff rate up to 15% for 150 days)

- Section 301 of the Trade Act of 1974 (for unfair trade practices)

- Section 232 of the Trade Expansion Act of 1962 (national security)

Section 301 and 232 tariffs both require a formal investigation before they can be legally imposed.

After the U.S. Supreme Court announced the ruling, Treasury Secretary Bessent stated that he expects tariff revenues will remain consistent in 2026.

However this shakes out, this could lead to more volatile trade policy and have a significant impact on the economy

Consumer Confidence

Though the inflationary impact of tariff implementation has been less than originally feared (at least, so far), the U.S. consumer is still leery of how looming tariffs will impact the economy.

Consumer sentiment (according to the University of Michigan Consumer Sentiment Index) hovered around its lowest ever readings for most of 2025, and even recorded a new all-time low in November.

Though it ticked up slightly in January and February, the index is still down around levels seen during the Great Recession.

Ultimately, inflation and the potential for future interest rate cuts are inextricably linked to changes in trade policy, which has been highly fluid.

Encouragingly, recent deals have de-escalated global tensions and the U.S. economy will begin to lap the effect from last year’s tariff implementation.

The Federal Reserve and Rate Cuts

After multiple rate cuts in 2024, the Fed sat tight until their September 2025 meeting, where they cut interest rates by 25 basis points (bps). The Fed cut rates by an additional 25 bps in October, and another 25 bps in December.

These cuts brought rates down to their lowest level since 2022.

At its January meeting, the Fed chose to keep rates steady. Though markets are pricing in one or two more rate cuts in 2026, most analysts do not anticipate any further rate cuts until the summer or later.

The Fed has a dual mandate of promoting both price stability and maximum employment.

Inflation remains stubbornly higher than the target rate (but stable), labor markets are soft (but stable), the macroeconomy is slowing and the housing market is stagnant.

All that has led to the Fed sitting tight for now. As Fed Chair Powell said at their last meeting, “[It is] hard to look at the data and say that policy is significantly restrictive right now.”

Industrial Demand

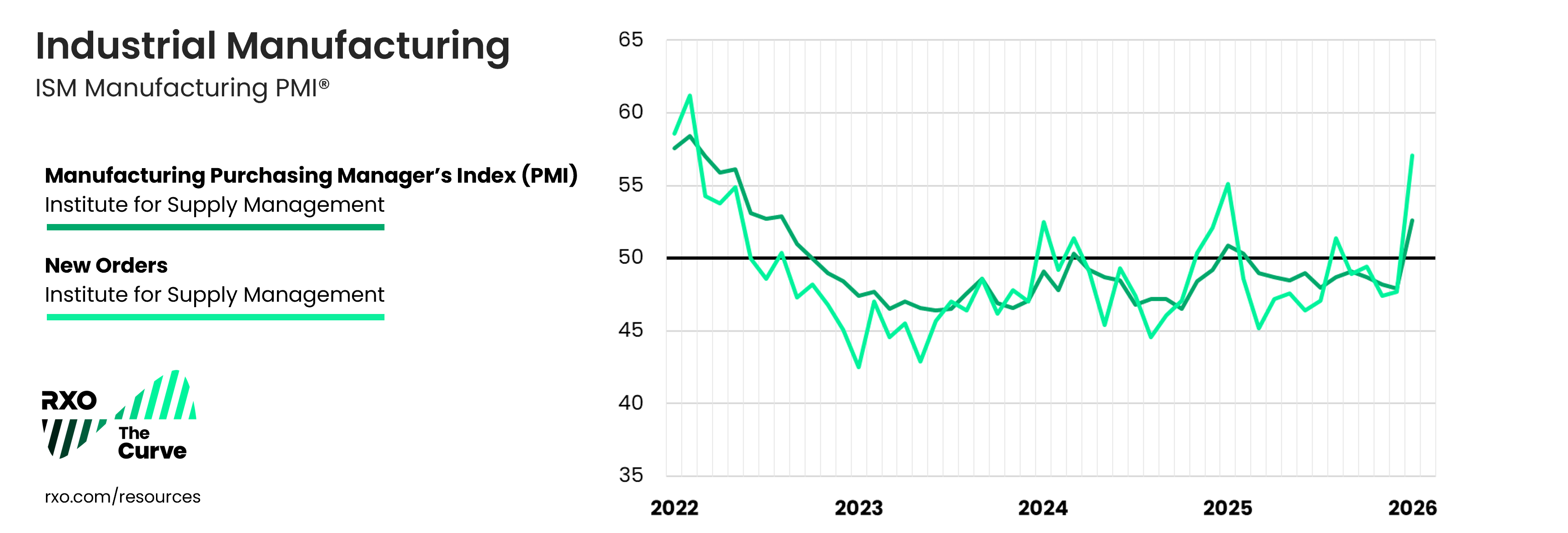

Early in 2025, the industrial sector of the U.S. economy was beginning to show signs of improvement.

After 26 straight months of contraction, the Manufacturing Purchasing Manager’s Index (PMI) entered expansionary territory in January and February, only to sink back into contraction for the rest of the year.

In January 2026, however, the index kicked off to a strong start, jumping into expansionary territory.

Furthermore, the New Orders component of the Manufacturing PMI — one of the strongest leading indicators for U.S. economic activity — jumped even higher.

Is this just a blip on the radar like we saw in early 2025, or is this new order expansion sustainable? If it holds, the U.S. trucking economy will see increased freight volumes, which, given the current capacity situation, would mean increased spot rates as well.

Key Economic Demand Indicators Driving the Truckload Market

Now that we’ve covered the broader economy, let’s look at some indicators that are most closely linked to truckload market activity.

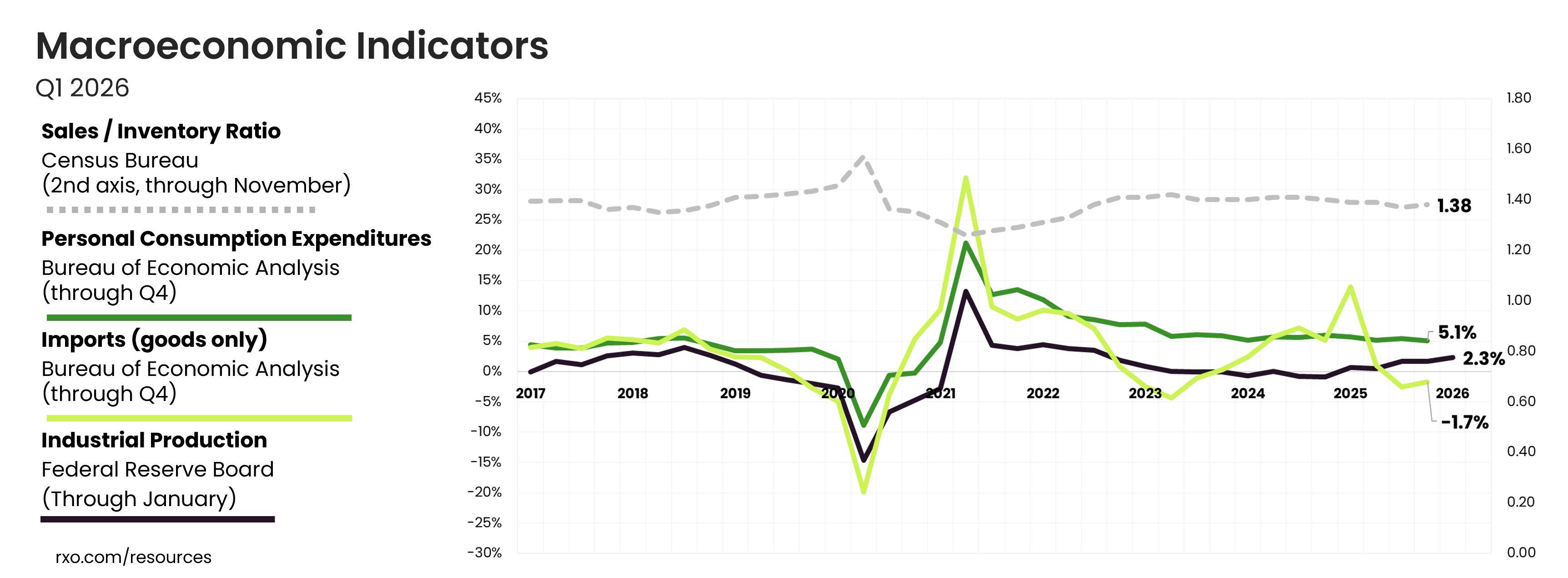

Overall, we’ve seen relative stagnation in these indicators (with the exception of imports; more on that below), perpetuating the trend of muted truckload volumes, which have, in turn, slowed down a freight market recovery.

Let’s examine the most recent available figures for industrial production, consumer spending, imports and inventories through the lens of how they are impacting truckload shipping.

Download all the Curve charts for your next presentation.

Note: Truckload Market Inflation/Deflation vs. Economic Growth/Recession

It’s worth noting that though the truckload market is linked to what happens in the wider economy, the two are not always coupled.

Given how supply and demand work in the truckload market, it’s possible for the economy to remain strong and the truckload market to languish. It’s also possible for the truckload market to inflate while the economy weakens (see the inflationary Curve in 2008 during the Great Recession).

More specifically, carriers are combating lagging freight volumes, a continuation of muted spot market rates (until recently) and inflation in their overall cost structures (labor, insurance, etc.).

A continuation of these trends could topple even more carriers who have been barely hanging on for the last two years. More recently, a supply-shock driven by enforcement actions have driven up rates, despite the soft demand environment.

Personal Consumption Expenditures

- What is it?

How much the American consumer is spending - How it impacts truckload shipping:

The more we buy, the more we need to produce (IP) and/or buy elsewhere (imports), which translates to greater demand for truckload shipping.

While we’ve had more than two years of persistent inflation and fears of a possible recession, consumer spending has remained stable, helping to buoy the overall economy.

Though the rate of growth has steadily slowed since Q4 2021, returning closer to the historical average, it is still growing — in Q4 the Personal Consumption Expenditures Index is at 5.1% year-over-year, essentially flat from Q3 (5.4%).

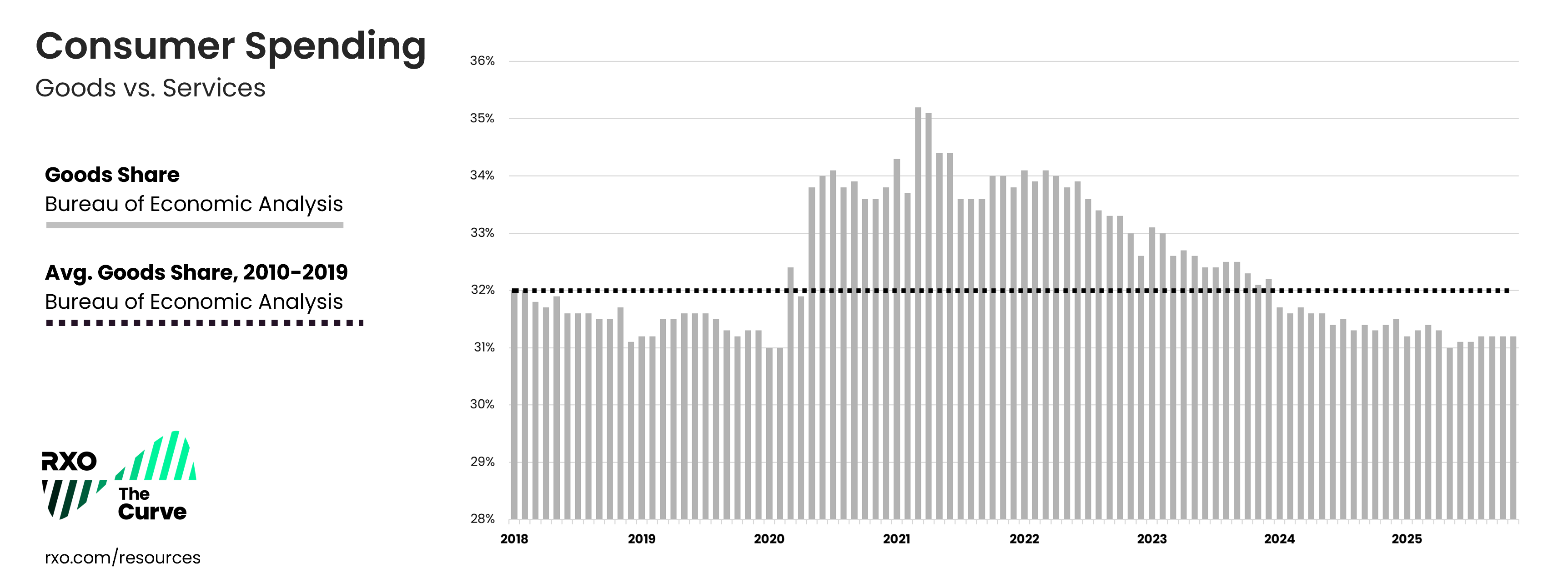

Goods vs. Services in Consumer Spending

When COVID struck, service-related industries closed and, in turn, demand for physical goods (which require more freight shipping) soared to 15-year highs in an incredibly short period of time, driving a commensurately high inflationary spot market.

Over the past several years post-COVID, U.S. consumers have increased their preference for services (vacations, dining, entertainment, etc.), which has decreased physical goods’ share of wallet, resulting in less freight.

Though the rate of decline for total spending on goods has stabilized, it is still tracking below the baseline average (32%) of the 2010’s. We’ll look for any increase in this to drive more freight demand in the future.

Industrial Production (IP)

- What is it?

Total value of physical goods America is producing - How it impacts truckload shipping:

The more we make, the more freight that needs to move, from raw material inputs to finished goods

After a short-term increase driven by tariffs (many shippers were scrambling to replenish inventories with non-tariffed goods before updated trade policies set in), this index has come back down to earth.

Imports (of goods, excluding services) ended Q4 at -1.7%, a sharp decline from Q1 at 14% year-over-year, though up slightly from Q3 (-2.5%).

Furthermore, continued consumer preference of services over goods could also have a dampening effect on import growth.

Imports (Goods Only)

- What is it?

Total value of physical goods America is buying from other countries - How it impacts truckload shipping:

The more we buy from other countries, the more freight that needs to move, from raw material inputs to finished goods

After a short-term increase driven by tariffs (many shippers were scrambling to replenish inventories with non-tariffed goods before updated trade policies set in), this index has come back down to earth.

Imports (of goods, excluding services) ended Q4 at -1.7%, a sharp decline from Q1 at 14% year-over-year, though up slightly from Q3 (-2.5%).

Furthermore, continued consumer preference of services over goods could also have a dampening effect on import growth.

Inventory-to-Sales

- What is it?

The ratio of physical goods businesses have in stock vs. how much they’re selling - How it impacts truckload shipping:

When inventory levels are high, it creates a delay in demand for truckload shipping, as businesses will work off excess inventory before producing new goods (IP) or buying more goods (imports).

After peaking at 1.42 in Q2 2023, the index has gradually trended down, ending Q3 at 1.37.

Many expected the ratio to increase in 2025 as shippers tried to stockpile non-tariffed goods prior to tariff implementation, however, with November (the most recent data available) ending at 1.37, it seems that shippers are back in a more normative restocking cycle and are once again more comfortable with a “just in time” inventory strategy.

Given recent supply chain stability, combined with consumer preference for the service economy, retailers have been reluctant to build up significant inventory levels like they did in 2022 and 2023.

Looking at another inventory benchmark, the December inventory reading on the Logistics Managers’ Index (LMI) hit an all-time low. While it ticked up in January, partly due to seasonality, inventory levels still remain below their long-term average.

To the extent that consumer demand improves, supply chain leaders may need to undertake restocking efforts to rebuild inventory levels (which would result in increased truckload demand).

Macroeconomy & the Truckload Market: Key Takeaways

- Despite continued headwinds over the past two years, the U.S. economy has avoided a recession (at least for the time being), buoyed by stable consumer spending.

- We are operating in a fluid environment — tariffs and trade policy are driving significant economic uncertainty, which has led to declining consumer confidence and rising long-term inflation expectations.

- There are a few signs for optimism in early 2026: moderating inflation, a potential increase in manufacturing, and rising consumer confidence

- The last time the freight cycle went inflationary (2020 – 2021), surging demand drove rate growth. For this inflationary leg, the current macroeconomic outlook doesn’t support a massive spike in demand — it’s more likely that supply-side constraints (carrier attrition) will be the driving force.

- That said, any increase in demand would drive supply chain volatility

Truckload Market Trends to Watch in Q1 2026

Let’s unpack a few of the key trends impacting the market before we dive into the updated Q1 forecast.

1. Spot rates continue to trail contract rates (for now).

For the past few years, shippers have used their transportation RFPs as opportunities to bring their contract rates (aka primary rates) back towards pre-pandemic levels — and they were largely successful.

Even though spot rates bounced off the bottom in 2023 and have been year-over-year inflationary since early 2024, they were, in absolute terms, unable to consistently overtake contract rates.

That all changed over the holidays, and through Q1 to-date, spot rates have held their advantage, bolstered by enforcement-related capacity attrition and nationwide winter storms.

The real question: is this dynamic sustainable, or will the market return to a baseline like we’ve seen in previous spikes over the past two years?

If this rise in spot rates is sustainable, contract rates will follow and routing guides that were set in the softer market will be pressured.

2. Federal policy enforcement is straining carrier capacity.

There are two federal policy initiatives, primarily aimed at the immigrant driver population, that have significantly impacted the carrier market.

Combined with increased immigration enforcement spending in the One Big Beautiful Bill Act, these policies have led to a noticeable reduction in the overall driver pool.

Let’s briefly unpack both.

English Language Proficiency

Existing federal law requires that all commercial truck drivers must: “read and speak the English language sufficiently to converse with the general public, to understand highway traffic signs and signals in the English language, to respond to official inquiries, and to make entries on reports and records.”

On April 28th, President Trump signed an Executive Order that places a renewed and increased focus on enforcement of the English proficiency standard.

Starting on June 25th, the Department of Transportation and FMSCA began enforcing this requirement, placing non-compliant drivers out-of-service.

Non-Domiciled CDLs

What is a non-domiciled CDL?

In brief, this type of state-issued CDL primarily applies to foreign nationals who are legally in the U.S., but not citizens or permanent residents. Note: This does not apply to Canada and Mexico, whose citizens must obtain their CDL from their home country.

A non-domiciled CDL gives these individuals the opportunity to drive in the for-hire truckload market, provided they complete an application, pass a driving test and provide authorization from U.S. Immigration.

What is happening to non-domiciled CDLs?

The FMCSA issued an interim final rule in late September, that, “Closes gaps in how states issue CLPs and CDLs to individuals from outside of the United States. It tightens eligibility, strengthens safeguards, and makes clear when these licenses must be canceled or revoked, delivering a more secure system and safer roads for all Americans.”

Or to put it simply for our context, it makes it significantly harder (or impossible) for many foreign nationals to drive a commercial vehicle in the U.S.

The FMCSA issued its final rule on February 13, which is set to go into effect on March 16, 2026.

The regulation is expected to significantly affect non-domiciled CDL holders and may cause labor shortages.

This rule significantly tightens eligibility by requiring specific, vetted employment authorization.

Employment authorization documents alone no longer qualify, and states must verify immigration status through the SAVE system. It also restricts non-domiciled CDLs to certain visa holders.

How much does this affect overall carrier capacity?

The FMCSA estimates that this will push 194,000 drivers out of the market.

The massive and highly fragmented U.S. truckload market is notoriously difficult to quantify, particularly the subsection of the driver population to whom this rule applies (i.e., owner-operators and small fleets), so it’s difficult to say exactly how much this will ultimately impact truckload capacity.

However, it is the biggest structural change to the supply side of the truckload market since trucking deregulation in 1980.

How long will it take for the drivers to exit the industry?

While the final rule gives up to five years before the expiration of relevant CDLs, when combined with ramped up immigration enforcement and English Language Proficiency enforcement, it’s likely that many of the drivers in this population have already opted out of the industry.

Another consideration — insurance companies will be far less likely to extend coverage to carriers that employ non-domiciled CDLs, which would effectively push them out of the market regardless of more direct government enforcement.

3. Carrier employment continues to wane.

As freight volumes and rates have been muted over the past two years, so has driver employment.

Looking at employment data from the Bureau of Labor Statistics (BLS) (which only accounts for W2 employees at fleets, not owner-operators), carrier attrition continues, and we can see drivers exiting the market.

All employees, truck transportation

(from the BLS, through January)

- Decreased sequentially for 33 of the past 36 months

- Decreased year-over-year for 33 consecutive months

Production & non-supervisory employees, long-distance trucking

(aka drivers, from the BLS, through December)

- Decreased sequentially for 27 of the past 36 months

- Decreased year-over-year for 32 consecutive months

4. Operating authorities continue to wane, too.

The FMCSA tracks carrier operating authorities (new grants, revocations and reinstatements).

As mentioned above, owner-operators do not generally show up in employment numbers. Looking at operating authority activity is another way to get a pulse check on a large, fragmented carrier base.

In 2025, there was a net decrease of -2,648, with 46% of those coming in the fourth quarter. The population has declined in 17 of the last 24 months, leading to a total decrease of over 19,000 operating authorities over that time frame (for context, there were around 100,000 additions from 2020 to 2022).

5. The supply / demand balance is fragile, and susceptible to any volatility.

We’ve outlined the capacity situation in detail (waning employment, decreasing authorities, pressure on the immigrant driver pool, low rates and low freight volumes).

Accelerated carrier attrition over the past year is taking its toll and has likely set up a more challenging shipper’s market later in 2026 with increased rate volatility.

And though demand has been soft, there are some reasons for optimism including recent industrial production data, government stimulus actions, and lean inventory positions.

Any improvement in truckload volume will create widespread capacity disruption (like we’ve seen around the winter storms in Q1).

Truckload Trends: Key Takeaways

- Freight volumes remain sluggish, but spot rates have overtaken contract rates, and this is likely to persist in the months to come

- Federal policy targeting immigration enforcement on the driver population is compounding an already tight driver market

- The speed and severity of the upward climb will depend on whether we get an increase in freight demand

- The capacity situation is much more fragile than at any point since 2022

Q1 2026 Truckload Market Forecast

We’ve covered the macroeconomic environment, and key trends — but where does it leave us going forward?

We predict the Curve will continue its move into inflationary territory.

We’re in a changing environment, and the carrier market is in a much more precarious place than it has been over the last few years.

January and February are often the slowest shipping months of the year, yet industry-wide tender rejections are at their highest levels since 2022 and are outpacing seasonality.

Rates and capacity may stabilize somewhat by the end of the first quarter, but the lull likely won’t last too long with Roadcheck and produce season right around the corner.

2026 Outlook

Though there has already been a significant impact, we expect carrier capacity to continue leaving the market with the full enforcement of the FMCSA Final Rule on non-domiciled CDLs.

As stated previously, we believe this represents the biggest structural change to the U.S. carrier market since industry deregulation in 1980 — much more than the ELD mandate in 2017.

Though 2025 contract rates slightly increased year-over-year in Q4, spot rates are finally rising at a faster rate. As the gap widens between the two, it will drive volatility as cash-strapped carriers look to increase profitability after a very difficult three years.

If we have a continuation of current capacity trends with an improvement in demand, most shippers’ contract rates will likely not be sustainable. The severity will hinge on stability (or lack thereof) in trade policy and the steepness of the improved demand curve.

Q1 2026 Forecast: Key Takeaways

- Though volatility may moderate somewhat later in the quarter, we are in a shifting market.

- The Curve index will remain in year-over-year inflationary territory, and finish Q1 higher than Q4.

- A continued increase in carrier exits driven by enforcement of new government rules and/or an increase in freight demand would drive the market higher into inflation.

- Though both the U.S. consumer and shippers may be hesitant, there are some reasons for optimism including recent industrial production data and government stimulus actions.

- We’re already in a fragile shipping environment, and any increase in demand will drive rates and volatility even higher.

Next Steps: Get Your KPIs in Order With the Latest Research

Did you know that 99% of carriers take shippers KPI expectations into account before agreeing to move a load with them?

As we head deeper into an inflationary market, it’s the perfect time to check yours up against industry standards.

We published the 2025 edition of our original, independent research study on logistics KPIs, and it’s loaded with insights and benchmarks, informed by 1,000 shippers and carriers.

Check out the research study now to start having a more data-driven network.